2017 Salary Survey: Surveying the Canadian design/construction landscape

BIM starting to boom, while green remains the same

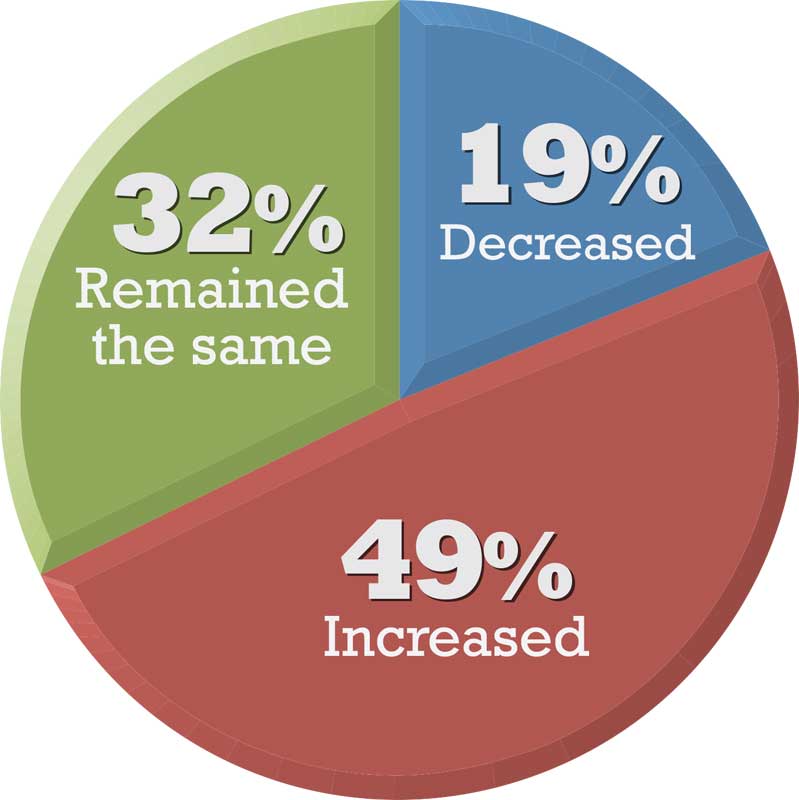

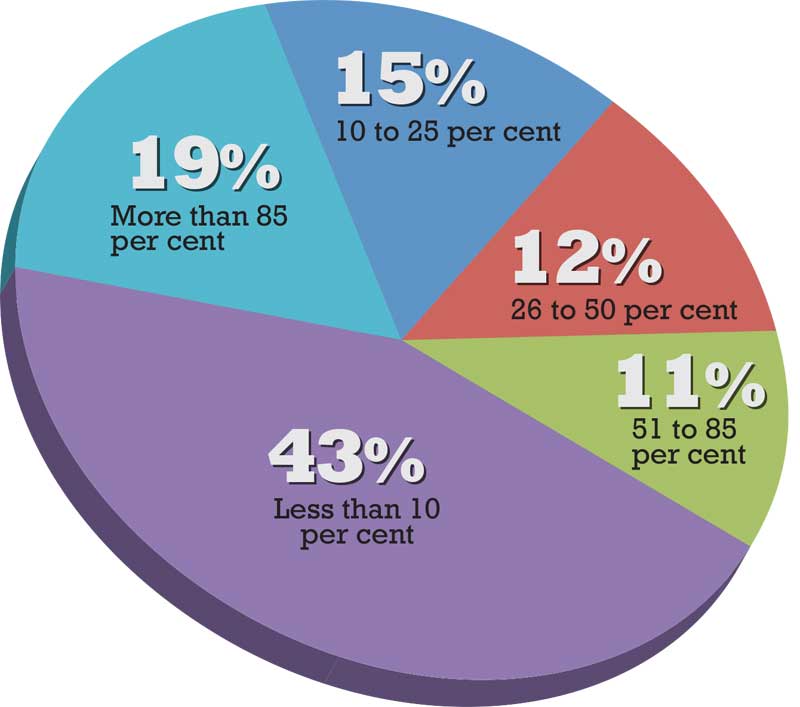

Building information modelling (BIM) approaches are continuing to grow in popularity—the number rises steadily each year. This time, a total of 42

per cent say their firm uses it on more than a quarter of all projects. Last year, that number was 36; in 2015, it was only 29 per cent.

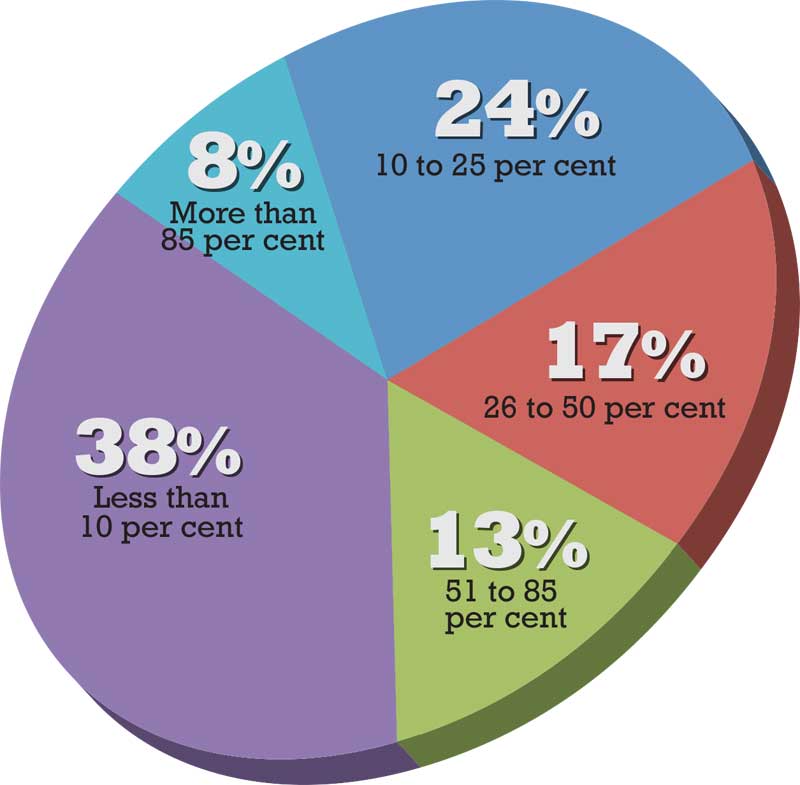

In terms of sustainability, only 21 per cent of respondents said they work on projects directly related to green design targets more than half the time—the exact number cited last year, and basically consistent with surveys past.

In some cases, being green is actually feared as a liability and hidden away from building owners who are focused on another kind of green— first costs.

“Clients are not willing to pay for green design; they want everything as cheap as possible,” said one Saskatchewan architect. “It’s the same old for every job, no matter how hard we try. I’m LEED-accredited and that can chase clients away so I don’t usually advertise my credentials.”

Predicting the future

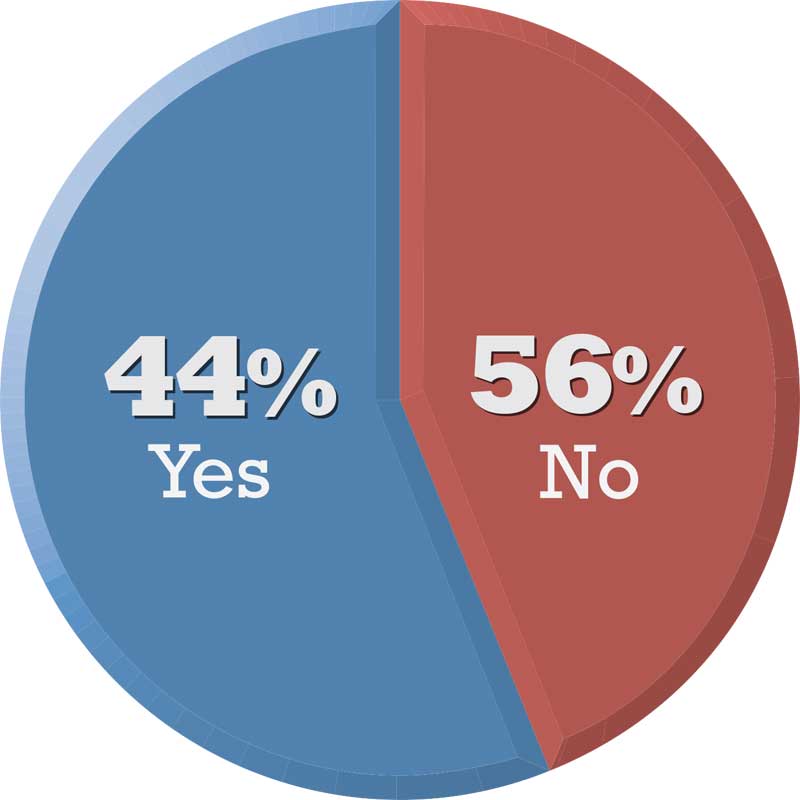

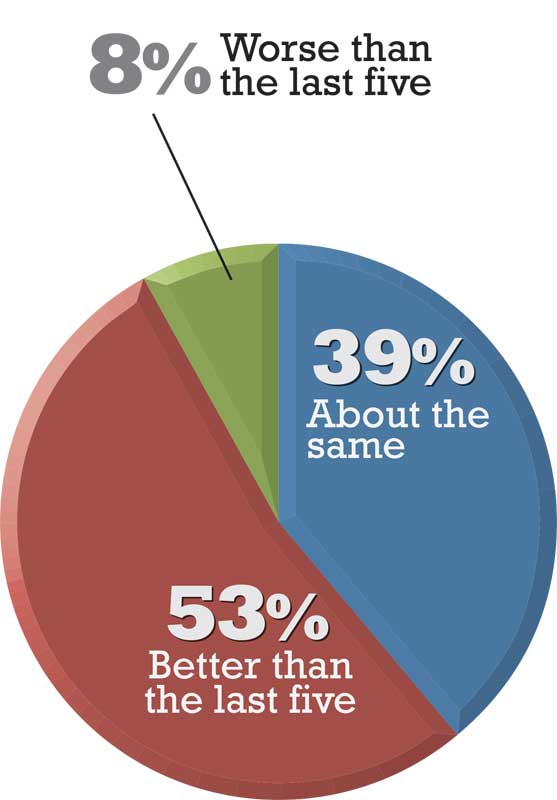

Judging by the survey, many in the design/construction industry have a right to be optimistic—only eight per cent see the next five years as particularly troubling. After all, 81 per cent say the last half-decade meant either increased or steady profitability.

“I’m predicting greater construction activity as the economy recovers from the financial crash,” suggested a B.C. engineer.

That’s not to suggest there aren’t any concerns, of course. Examples ranged from provincial budgets and stricter energy codes to market fluctuations and, in the words of a Québec architect, “my stupid boss.”

“For the first time in 20 years of working, times are slow,” wrote an interior designer from Manitoba. “Fees offered by other businesses and competitors are too low and not in line with the type of work—I’m not sure how they are making money.”

“Less dollars are being spent on construction in Western Canada, especially related to oil and gas projects,” said an installer from Alberta. “Plus, outside competition from eastern provinces are now bidding here, which is eroding margins.”

We also asked what could be the single biggest factor impacting design/construction firms over the next few years. The top five mentioned were:

- the economy (including interest rates and oil prices);

- general market activity (such as growth in sectors like the housing market or infrastructure spending);

- Canada’s political landscape (from new regulations to new parties in power at various levels);

- staffing (i.e. hiring and retaining quality practitioners); and

- the United States (whether that means NAFTA or influence over the global economy).

However, many other respondents looked inward and decided they and their partners would have the biggest influence on their career.

“There will always be roofs to build and rebuild,” said a product representative from Québec. “I believe that our growth is linked to the constant quality of our products and the efficiency of our employees.”